Just when you were starting to get into the swing of sports in 2023, there is a looming catastrophe on the near horizon.

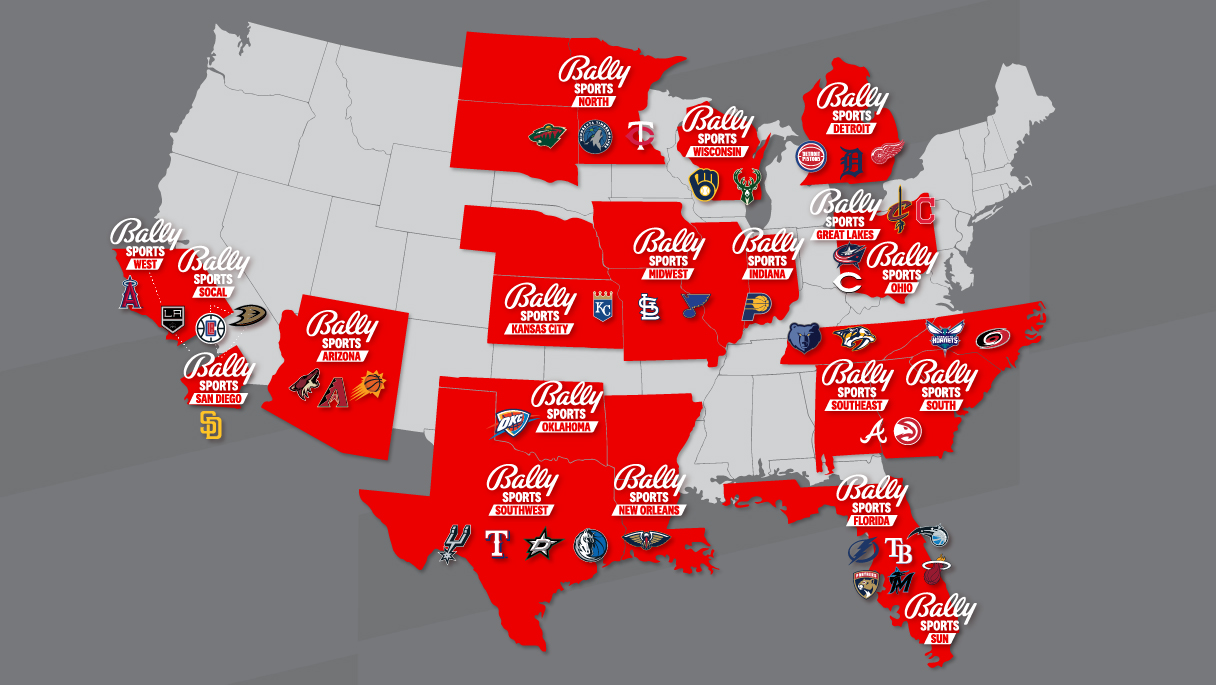

It was reported by multiple sources this weekend that Diamond Sports Groups, a collective of 19 regional sports networks (RSN) will declare bankruptcy this coming week.

The Chapter 11 filing will permit Diamond to restructure its mountainous debt; Diamond does business as Bally Sports.

Diamond/Bally Sports is owned by Sinclair Broadcasting Group.

The catastrophe that is coming is the shutting off of revenue streams generated by broadcasting National Hockey League, National Basketball Association, and Major League Baseball, as well as minor league hockey in a wide swath of the US geography.

Sinclair bought the RSN in 2019 with its US$9.6B debt. On its face, that just seems unsustainable.

What is driving the Chapter 11 filing this week is a US$140M interest payment due during the week.

Several of the reports have spotlighted the Miami Heat, St. Louis Cardinals, and Tampa Bay Lightning as being in particular difficult exposure with the bankruptcy.

All this when the NHL is nearing its trade deadline on 3 March, one has to wonder from where the cash for big name assets will be drawn.

Reports are that MLB will go forward on digital and traditional cable outlets if Sinclair/Bally Sports goes dark.

The digital streaming options have become dramatically unpopular as prices soar.

Data culled from MoffettNathanson demonstrate a dramatic decrease in steaming accounts since 2014, as reported on Sportico.

If the revenue flows are shut off to NBA and NHL franchises there will be damage done to each. The loss of RAN-sourced broadcasting could cripple already fragile markets and franchises.

As SportsMediaWatch reports Sinclair/Bally has $585 million in cash on hand; the group owes US$2B in TV rights to franchises.

No amount of planning can make up that shortfall in revenue.

If, as reported, Sinclair/Bally file for Chapter 11 protection, the RSN would be faced with a Hobson’s choice of renegotiating contracts or suspending broadcasts.

Bloomberg reports that in a Chapter 11 filing, the accrued debt would become equity with ownership then spread to the largest debt holder in the Sinclair Bally Sports RSN. That group includes Prudential Financial, Fidelity, Hein Park Capital Management, and Mudrick Capital Management.

The National Football League and Major League Soccer are outside the threat zone from this action as both leagues broadcast over national and international platforms.

Note: Thanks to Chris Riley on alerting PHN to the news

You must be logged in to post a comment.